In order to be able to contact your customers digitally or by telephone in a legally secure manner, the corresponding consent is required according to the GDPR. If this consent is not available, digital interaction becomes a real challenge.

A systematic development of a consent management leads to:

- Increased customer satisfaction, your customers want more digital interaction

- Increased customer loyalty and referrals

- Even more opportunities for cross-selling

- Reactivation of unserviced customer bases through digital interaction

Financial service providers have recognised the issue, but face a major challenge in implementing it. Our study clearly shows that more than 80% of customers have not given their consent for a digital approach.

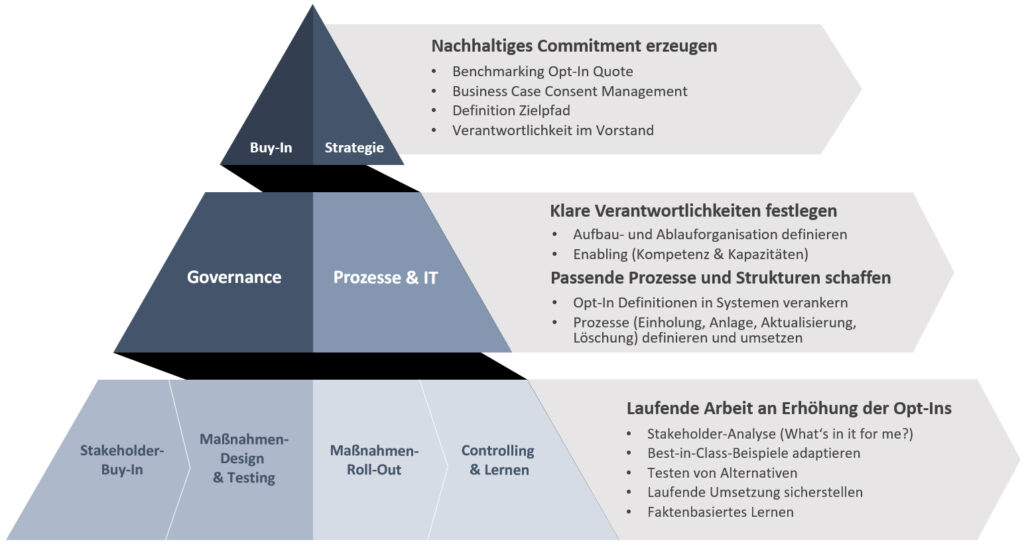

This is exactly where our approach comes in; we support you in the development of a holistic consent management approach. Get in touch with us now.